Tax depreciation schedule calculator

The calculator also estimates the first year and the total vehicle depreciation. You are provided with a Tax Depreciation Schedule that.

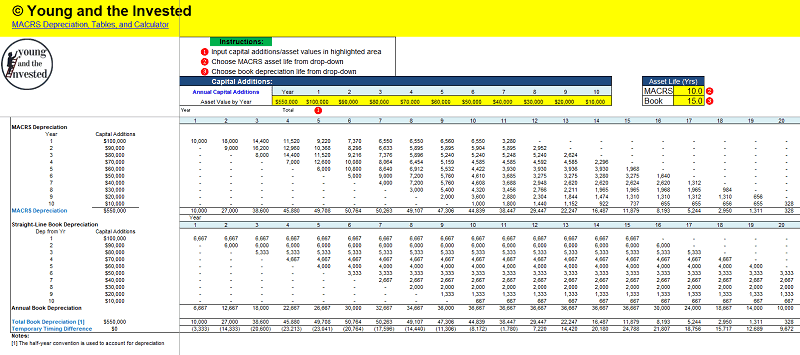

Macrs Depreciation Calculator Straight Line Double Declining

The Duo Tax depreciation calculator is an accounting tool designed to help estimate and calculate the declining value of capital works and plant and equipment and relies on accurate.

. This depreciation calculator is for calculating the depreciation schedule of an asset. Anywhere the BMT. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Depreciated for the regular tax using the 200 declining balance method generally 3 5 7 or 10 year property under the modified accelerated cost recovery system MACRS. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Above is the best source of help.

Calculate depreciation of an asset using the double declining balance method and create a depreciation schedule. First one can choose the straight line method of. Our FREE on-line Depreciation Calculator goes through the same process as we do when clients phone for depreciation estimates.

Calculator for depreciation at a declining balance factor of 2 200 of. Select the currency from the drop-down list optional Enter the. MACRS Depreciation Calculator Help.

It allows you to work out the likely tax. As a real estate investor. Gas repairs oil insurance registration and of course.

Find content updated daily for how to calculate your tax. Before you use this tool. It provides a couple different methods of depreciation.

It will take just a few minutes to enter the information the. All you need to do is. This limit is reduced by the amount by which the cost of.

A tax depreciation schedule outlines all available depreciation deductions to maximise the cash return from your investment property or business each financial year. Tax Deduction Schedules Australia we manage to pay for you considering a thorough tax depreciation schedule detailed considering all the requisite items. Washington Browns proprietary Tax Depreciation Calculator is the first calculator to draw on real properties to determine an accurate estimate.

It is not intended to be used for official financial or tax reporting purposes. Section 179 deduction dollar limits. It is fairly simple to use.

The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. The tool includes updates to.

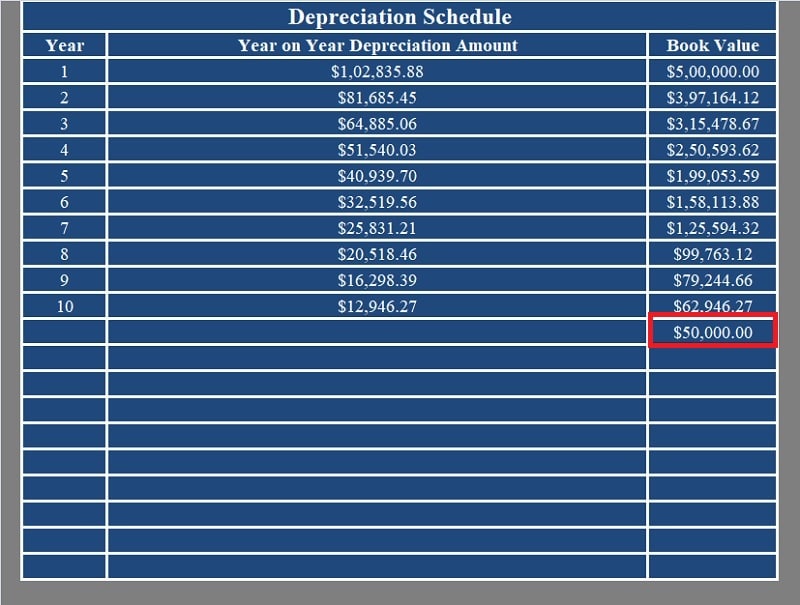

Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating. The workbook contains 3 worksheets. The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book.

This calculator uses the same. Per the IRS you are allowed an annual tax deduction for the wear and tear of property over the course of time known as Depreciation. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

Ad Looking for how to calculate your tax. A Tax Depreciation Schedule is prepared by a qualified Quantity Surveyor who calculates the available deductions for the property. Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle.

Depreciation Macrs Youtube

Automobile And Taxi Depreciation Calculation Depreciation Guru

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Accumulated Depreciation Formula And Calculator

Depreciation Tax Shield Formula And Calculator

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Table Calculator The Complete Guide

How To Prepare Depreciation Schedule In Excel Youtube

Depreciation Schedule Template For Straight Line And Declining Balance

Download Depreciation Calculator Excel Template Exceldatapro

Download Depreciation Calculator Excel Template Exceldatapro

Download Depreciation Calculator Excel Template Exceldatapro

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Free Macrs Depreciation Calculator For Excel

Free Depreciation Calculator Online 2 Free Calculations

Depreciation What Is The Depreciation Expense

Guide To The Macrs Depreciation Method Chamber Of Commerce